Chapter 10

Cash Controls

300

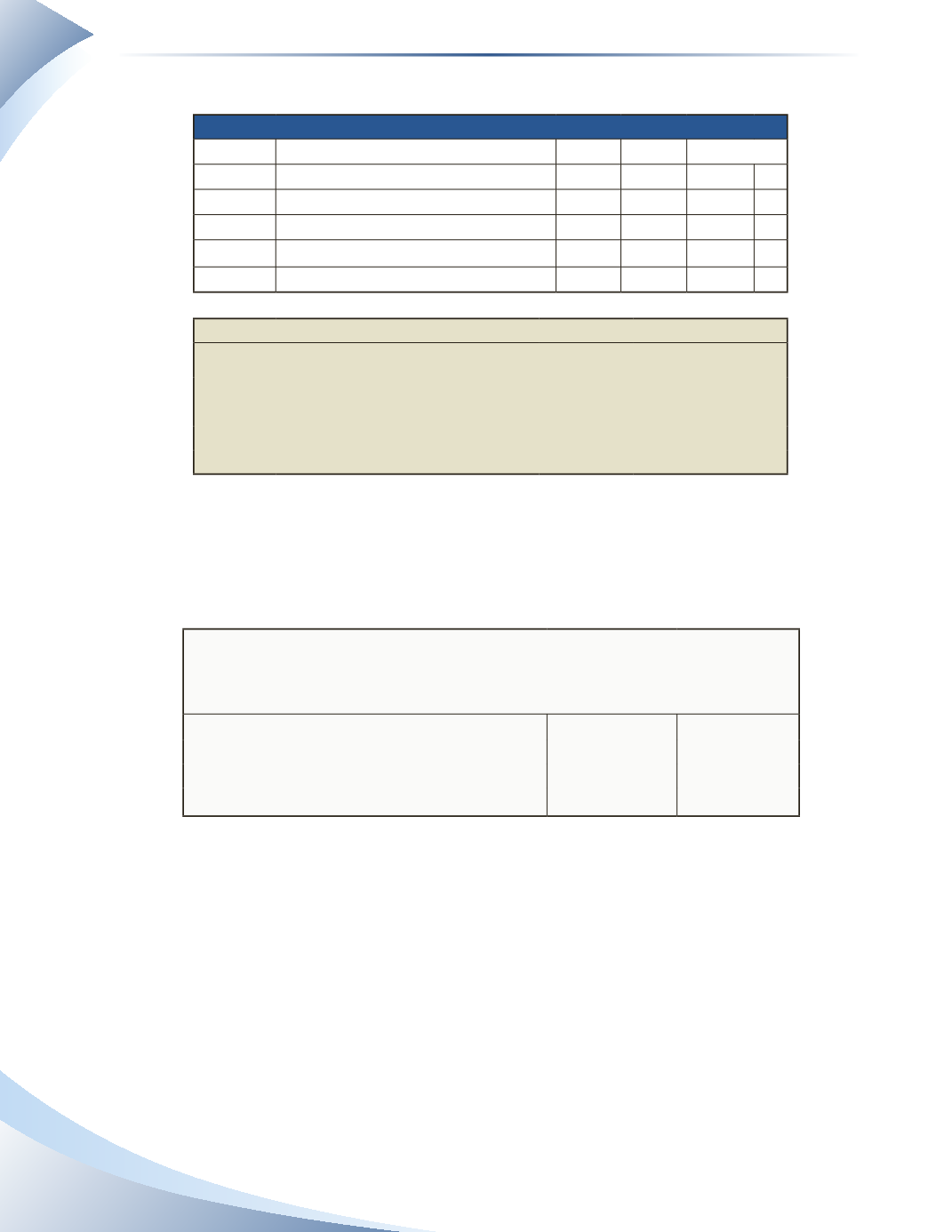

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

DR CR

Balance

Jun 1 Opening Balance

5,000 DR

Jun 2 Cheque #1

300 4,700 DR

Jun 3 Cheque #2

500 4,200 DR

Jun 10 Cheque #3

700 3,500 DR

Jun 30 Deposit

1,000

4,500 DR

Bank Statement

June 1–June 30, 2016

Date

Description

Withdrawal Deposit Balance

Jun 1 Opening Balance

5,000

Jun 2 Cheque #1

300

4,700

Jun 3 Cheque #2

500

4,200

Jun 10 Cheque #3

700

3,500

______________

Figure 10.14

The balance on the bank statement is $3,500.The balance in the general ledger is $4,500.There was

a deposit of $1,000 on June 30 that was not recorded by the bank. Since the balance is missing from

the bank statement, it should be added to the bank balance as shown in Figure 10.15.

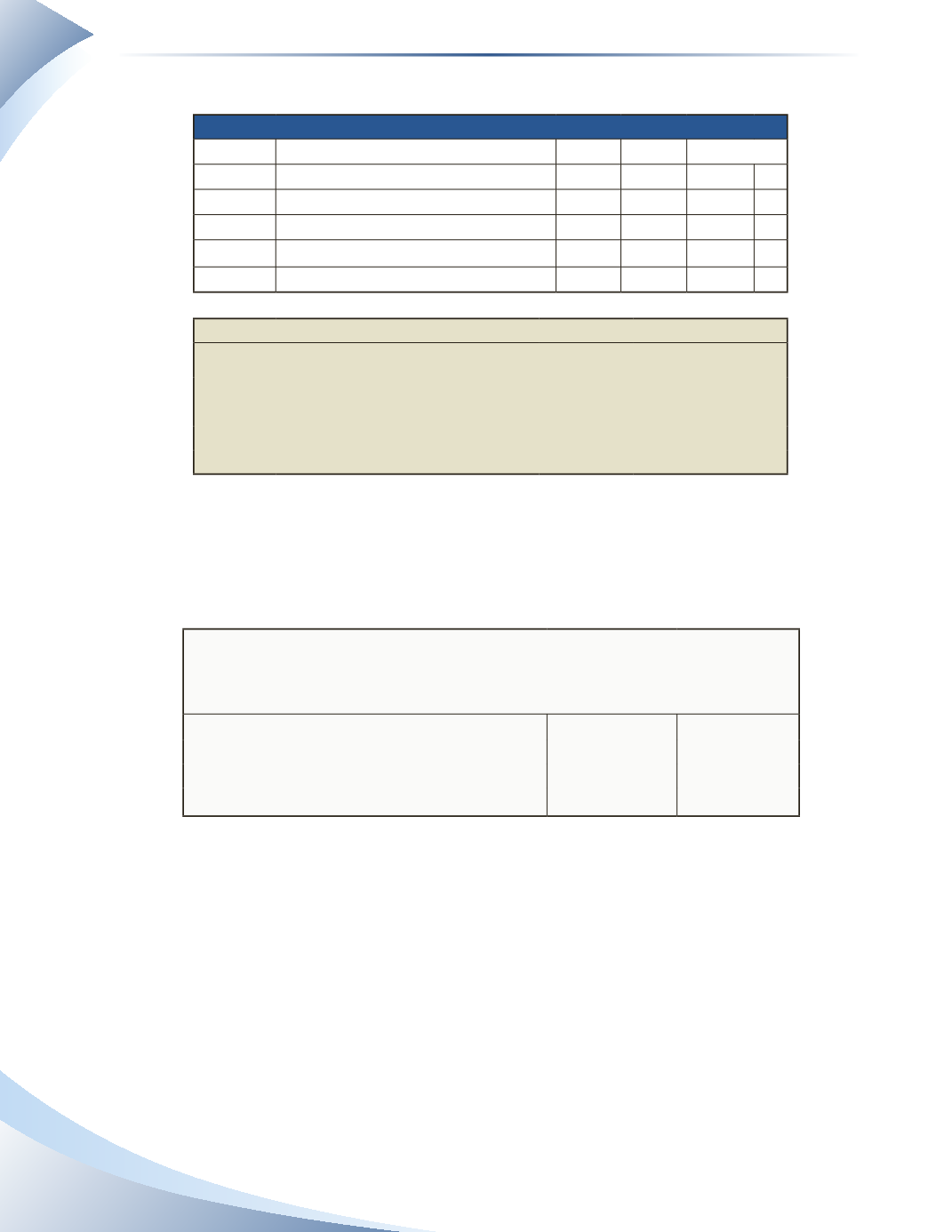

HR Clothing

Bank Reconciliation

June 30, 2016

Ledger

Bank

Balance as per records

$4,500

$3,500

Add:

Outstanding deposit June 30

1,000

Reconciled balance

$4,500

$4,500

______________

Figure 10.15

Notice that the reconciled balances are the same for the bank and the ledger columns.There is no

adjustment required in the ledger because the entry is only in the bank account column of the bank

reconciliation worksheet. The outstanding deposit is a timing difference; it should appear on the

bank statement which includes the following business day (in July). If the deposit does not show

up within one or two business days, further investigation should be made to rule out theft or fraud.