Chapter 10

Cash Controls

299

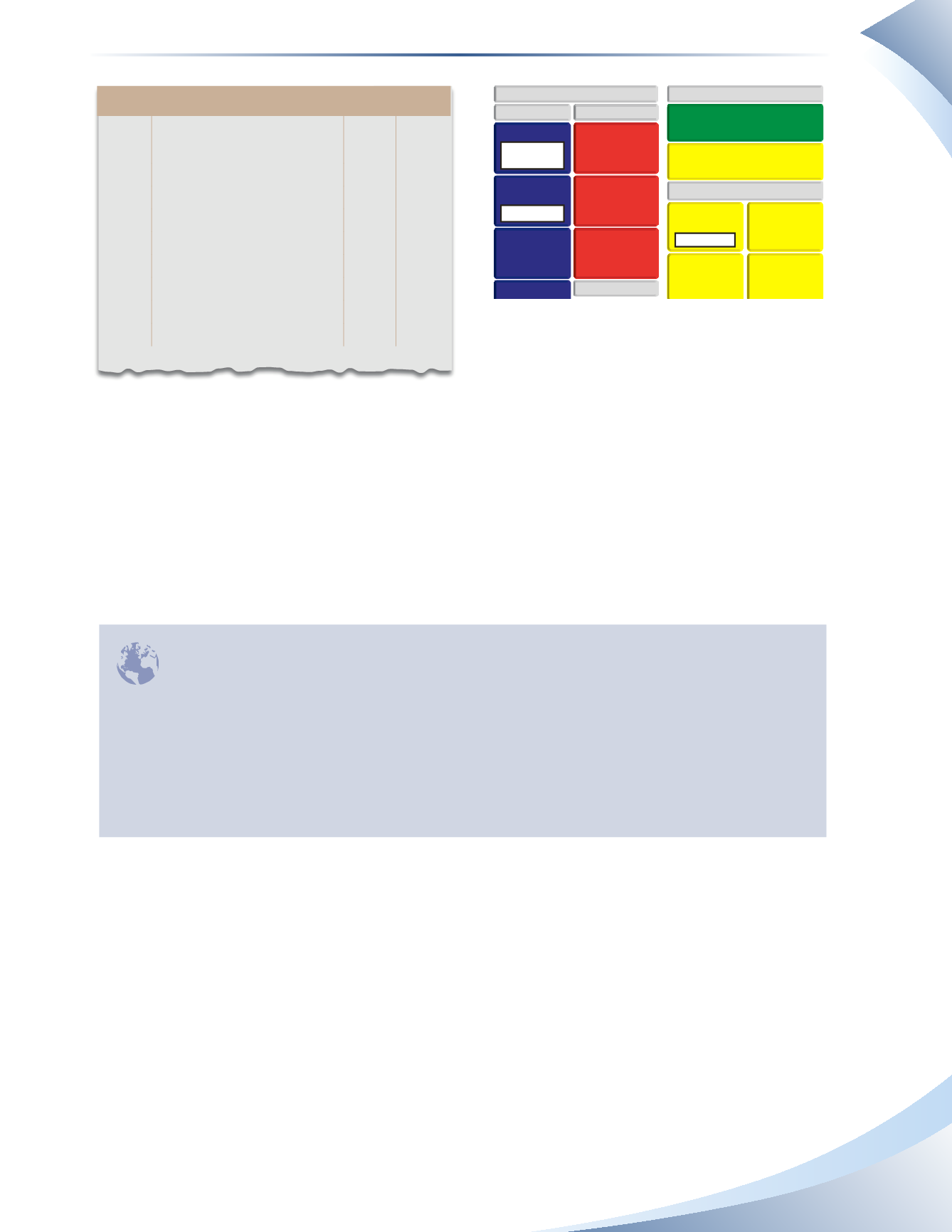

ACCOUNTS

RECEIVABLE

INCOME STATEMENT

SALES REVENUE

ACCOUNTS

PAYABLE

INVENTORY

ASSETS

BALANCE SHEET

LIABILITIES

CASH

OWNER’S EQUITY

UNEARNED

REVENUE

LOANS

PAYABLE

–

–

$400 CR

$10 CR

+

$400 DR

NSF

CHARGES

INSURANCE

RENT

SALARIES

+

$10 DR

COST OF GOODS SOLD

GROSS PROFIT

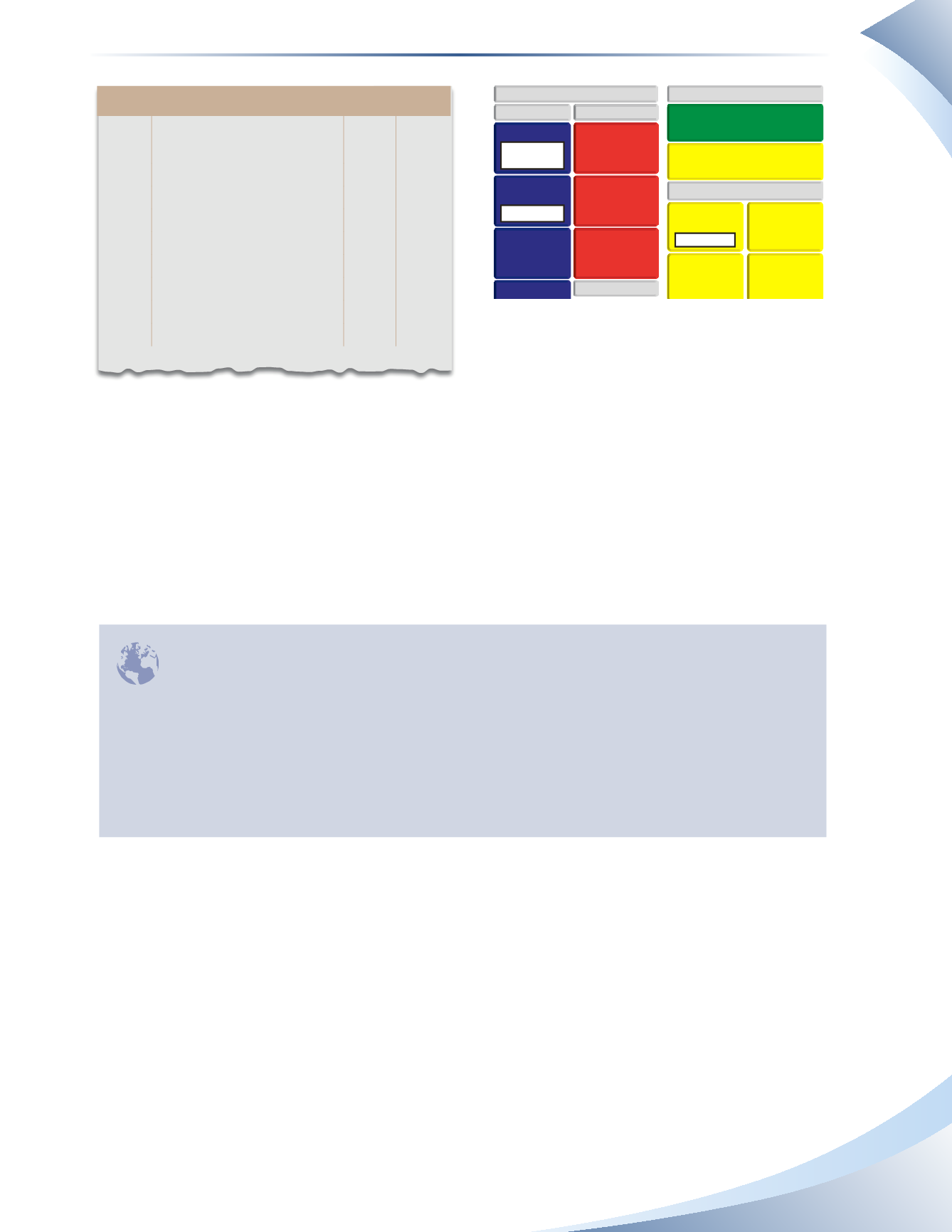

Journal

Page 1

Date

account title and

explanation

Debit Credit

2016

Jun 30 Accounts Receivable

400

Cash

400

NSF cheque returned by bank

Jun 30 NSF Charges Expense

10

Cash

10

Bank charge for NSF cheque

______________

FIGURE 10.13

Notice that HR Clothing received a charge because the customer was unable to honour the cheque.

The company will not want to have to pay the extra fee for the customer’s error. HR Clothing will

create a new invoice to the customer, charging the customer an extra amount to cover the NSF

fee. Some companies just charge the customer the NSF fee it was charged, in this case $10. Other

companies charge the customer a flat fee greater than the NSF charge of $10 to cover the NSF fee

and to cover the administrative process of handling the NSF cheque.

Non-sufficient funds (NSF) cheques are commonly known as bad cheques or bounced cheques. In

our example, it is assumed that non-sufficient funds (NSF) cheques occur because the issuer of the

cheque does not have enough money in their own bank account to support the cheque. However,

NSF cheques can result from a variety of reasons including.

1. The issuer purposely cancels the cheque.

2. The account is frozen.

3. The account does not exist (i.e. the issuing party engaged in a fraudulent act).

4. The account is under investigation.

INTHE REAL WORLD

outstanding Deposits

An outstanding deposit is one that has been recorded in the company’s general ledger but not

shown on the bank statement.These are also referred to as

deposits in transit

.This can occur when

the company makes a deposit in the bank (perhaps using the night deposit box) on the last day of

the month, but the bank does not record the deposit until the following business day—in the next

month.The bank statement and the company’s ledger account may appear as shown in Figure 10.14.