Chapter 10

Cash Controls

296

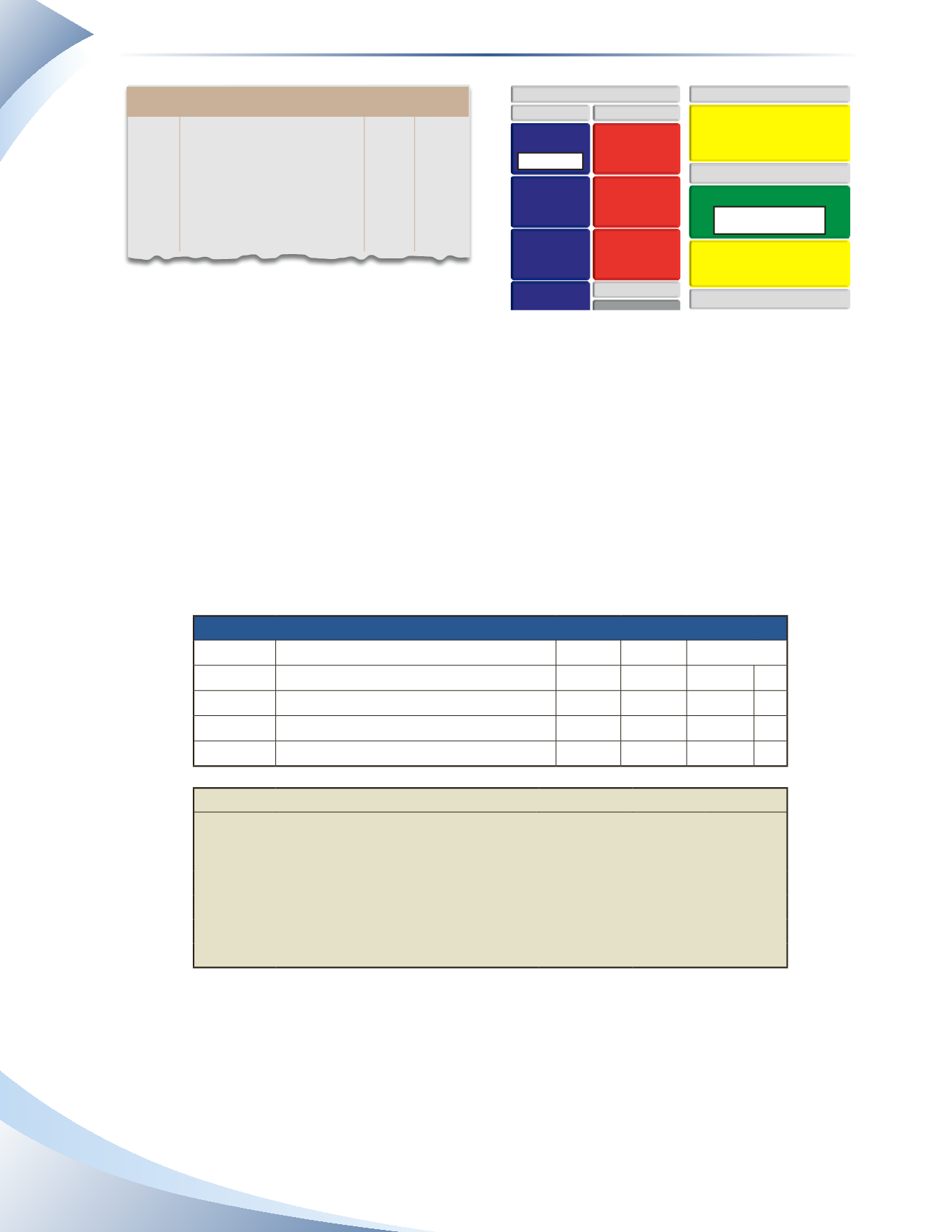

Journal

Page 1

Date

account title and

explanation

Debit Credit

2016

Jun 30 Cash

5

Interest Revenue

5

Bank interest earned

______________

FIGURE 10.7

ACCOUNTS

RECEIVABLE

INCOME STATEMENT

ACCOUNTS

PAYABLE

INVENTORY

ASSETS

BALANCE SHEET

LIABILITIES

CASH

OWNER’S EQUITY

UNEARNED

REVENUE

LOANS

PAYABLE

+$5 DR

OWNER’S CAPITAL

NET INCOME (LOSS)

OPERATING EXPENSES

OPERATING INCOME (LOSS)

OTHER REVENUE

OTHER EXPENSES

(INTEREST, LOSS ON SALE OF ASSETS)

INTEREST REVENUE

+$5 CR

unrecorded Charges from the Bank statement

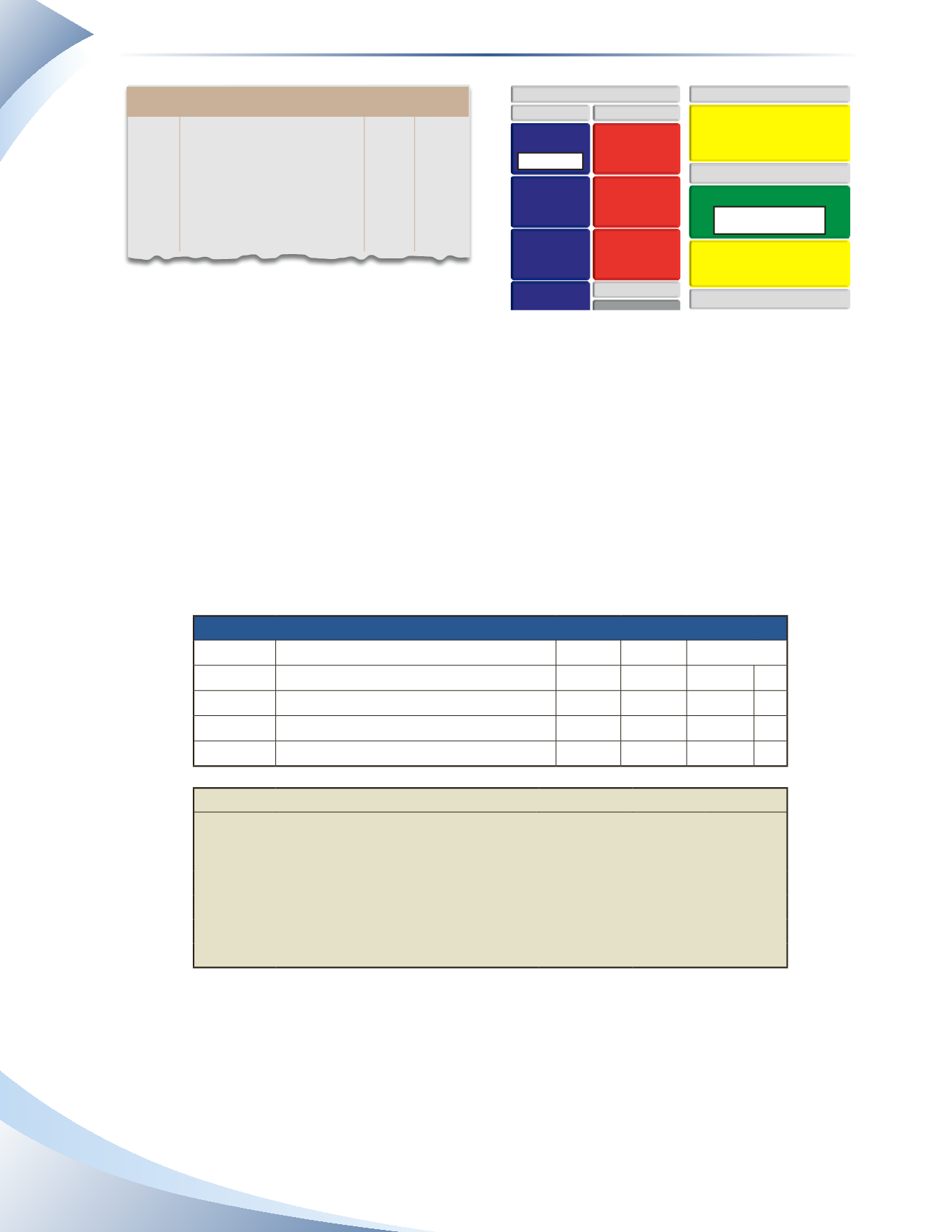

As with unrecorded deposits, there may be charges shown on the bank statement that are not yet

recorded in the general ledger. Typical examples are the monthly bank charges or an annual fee for

a safe deposit box. Such charges should be adjusted in the ledger.

Figure 10.8 shows that HR Clothing has a cash ledger balance of $3,500. The bank statement

reflects a balance of $3,450. All cheques are recorded in both the bank statement and the general

ledger. Upon comparison, the bookkeeper of the company notices that the bank recorded bank

charges of $50 on the last day of the month.This change must be updated in the general ledger.

general leDger

account: Cash

gl. no. 101

Date

Description

Dr Cr

Balance

Jun 1 Opening Balance

5,000 DR

Jun 2 Cheque #1

300 4,700 DR

Jun 3 Cheque #2

500 4,200 DR

Jun 10 Cheque #3

700 3,500 DR

Bank statement

June 1–June 30, 2016

Date

Description

Withdrawal Deposit Balance

Jun 1 Opening Balance

5,000

Jun 2 Cheque #1

300

4,700

Jun 3 Cheque #2

500

4,200

Jun 10 Cheque #3

700

3,500

Jun 30 Bank Charges

50

3,450

______________

FIGURE 10.8