Chapter 2

Linking Personal Accounting to Business Accounting

29

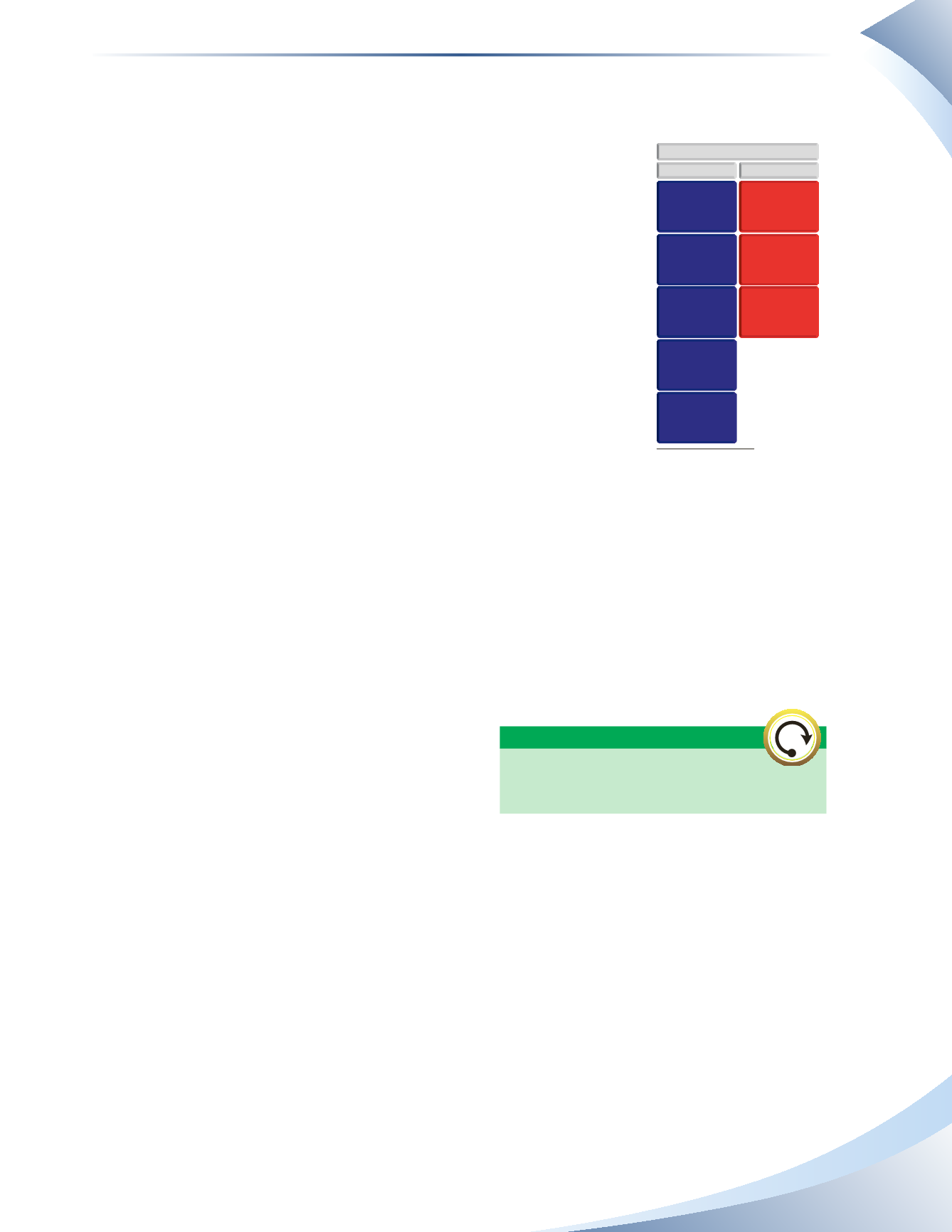

Sequence of Assets and Liabilities

The assets of a business are listed in sequence according to their liquidity.

Liquidity

is the ease with which the asset can be converted to cash.

Cash is the most

liquid asset

and is therefore listed first on the balance

sheet, followed by accounts receivable (the amount of money owed by

customers to the business), inventory, and so on. Property, plant and

equipment, such as buildings and machinery, are the least liquid and are

therefore listed last.

Liabilities are also listed in sequence in a similar way. Those that

are payable within the shortest amount of time are listed first (e.g.

accounts payable). These amounts are usually due within one year of

the balance sheet date. Debts that will last longer, such as bank loans,

are listed last.

Equity vs. Net Worth

Equity is the net worth of a business, after all assets have been sold and all liabilities have been paid.

Different business organizations classify who this equity belongs to in the following ways

•

In a proprietary business (owned by a single person), it is referred to as

owner’s equity

.

•

In a partnership, it is referred to as

partners’ equity

.

•

In a corporation, it is referred to as

shareholders’ equity

. Owners of a corporation buy shares

to indicate ownership and own a percentage of the company.

•

Some government institutions refer to it as

accumulated surplus (deficit)

.

All these terms represent equity of an organization,

which is similar to net worth introduced in personal

accounting. For the next few chapters in this text-

book, we will focus on a proprietary business and will

use the term owner’s equity to describe the equity of

the business. At the end of the accounting period,

the ending owner’s equity balance can be calculated

as follows.

Ending Owner’s Equity = Beginning Owner’s Equity + Owner’s Contributions + Net Income (Loss) - Owner’sWithdrawals

Owner’s contributions

is the amount of cash or assets invested in the business by the owner.

Owner’s withdrawals

is the amount of cash or assets taken by the business owner for personal use.

If a company is brand new and has just started operations, then beginning owner’s equity will be

equal to $0. If a company has been established for at least one accounting period, then the begin-

ning owner’s equity is equal to the previous period’s ending owner’s equity.

2

ASSETS

BALANCE SHEET

LIABILITIES

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

EXPENSES

INVENTORY

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

BUSINESS

FIGURE 2.2

The accounting equation is

Assets = Liabilities + Owner’s Equity

WORTH REPEATING