Chapter 12

Using Accounting Information

368

Gross Profit Margin

The gross profit margin is used to demonstrate the impact of cost of goods sold on the income

statement. In other words, the gross profit margin subtracts cost of goods sold from sales revenue,

the result of which is divided by sales revenue.The formula is shown below.

=

Gross Profit*

Gross Profit Margin

Sales Revenue

*Gross Profit = Sales Revenue – Cost of Goods Sold

Gross profit margin

reveals the percentage of revenues left after costs which are directly involved

in producing the goods or services of the business are deducted. That is, the amount of profits

remaining after deducting the cost of goods sold. The remainder is used to pay for operating and

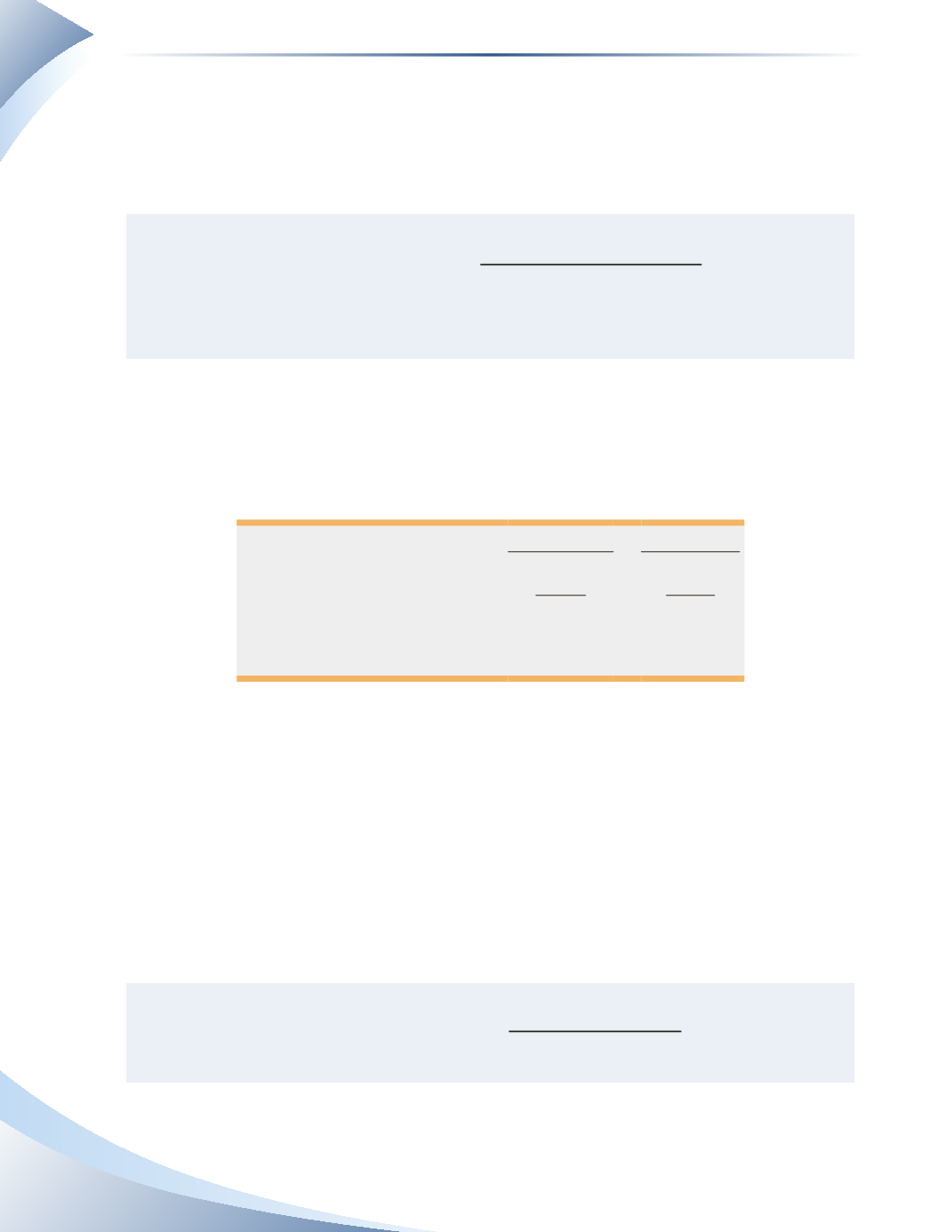

other expenses. Figure 12.17 calculates the gross profit margin using figures from Second Cup’s

income statement for 2013 and 2014.

2014

2013

Gross Profit

$20,493

$23,134

Total Revenue

$28,172

$27,188

Gross Profit Margin

73%

85%

_______________

Figure 12.17

A higher gross profit margin means that the company has an easier time covering its expenses and

is more likely to be profitable. However, gross profit margins should be compared to an industry

average to determine whether they are healthy or not. Also, a decline in the gross profit margin,

such as with Second Cup, indicates that the company is either not generating enough revenue, has

experienced an increase in inventory costs or both.

Net Profit Margin

The

net profit margin

assesses a company’s profitability after all expenses have been deducted.This

is the amount of net profit or loss per dollar of revenue.The formula is shown below.

=

Net Income

Net Profit Margin

Sales Revenue

As with the gross profit margin, a higher net profit margin is generally considered a better sign

than a lower one, although it should be always be compared to an industry average and previous