Chapter 12

Using Accounting Information

369

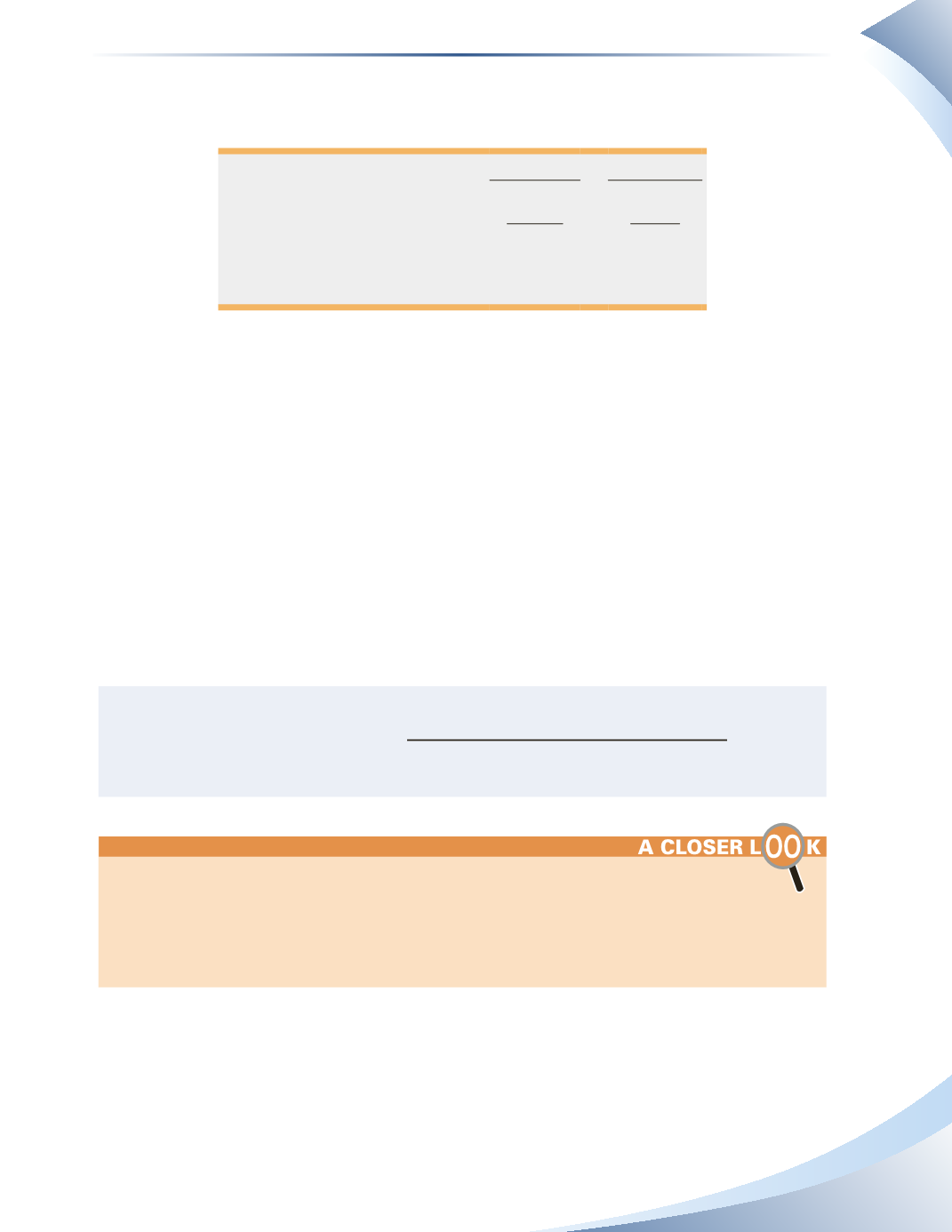

results. Figure 12.18 calculates the net profit margin margins for Second Cup for both 2013 and

2014.

2014

2013

Gross Profit

($27,032)

($7,369)

Total Revenue

$28,172

$27,188

Net Profit Margin

−

96%

−

27%

_______________

Figure 12.18

Although total revenues have increased since 2013, net income has remained negative and

significantly worsened. This is a bad sign for the shareholders because their investments have not

earned a return in more than two years. To perform a complete analysis of net profit margins,

comparisons should be made on a monthly and yearly basis to historical company performance,

industry averages and direct competitors. Only then will these net income figures be placed in

context so that conclusions can be drawn.

Return on Equity (ROE)

Return on equity (ROE)

is a measure of what the owners are getting out of their investment in

the company. It is often the most important ratio for investors because it has a large impact on the

value of one’s investment.This ratio requires information from both the balance sheet and income

statement to be calculated.The formula is shown below.

=

Net Income

Return on Equity

Average Shareholders’ Equity

The return on equity formula assumes that there is no preferred share equity included in

shareholders’ equity. If preferred equity exists, the formula would be as follows:

Return on Equity = (Net Income − Preferred Dividends) ÷ Average Common Shareholders’ Equity

Preferred shares are beyond the scope of this course.

Notice that the calculation requires average shareholders’ equity.Whenever a ratio is calculated that

uses some information from the balance and some from the income statement, the balance sheet

information is always averaged. This is because the balance sheet represents a snapshot in time

while the income statement represents an entire accounting period. By averaging the balance sheet

accounts, we are simulating a figure that covers the same period of time as the income statement.

This makes the ratio more comparable and reliable.