Chapter 12

Using Accounting Information

367

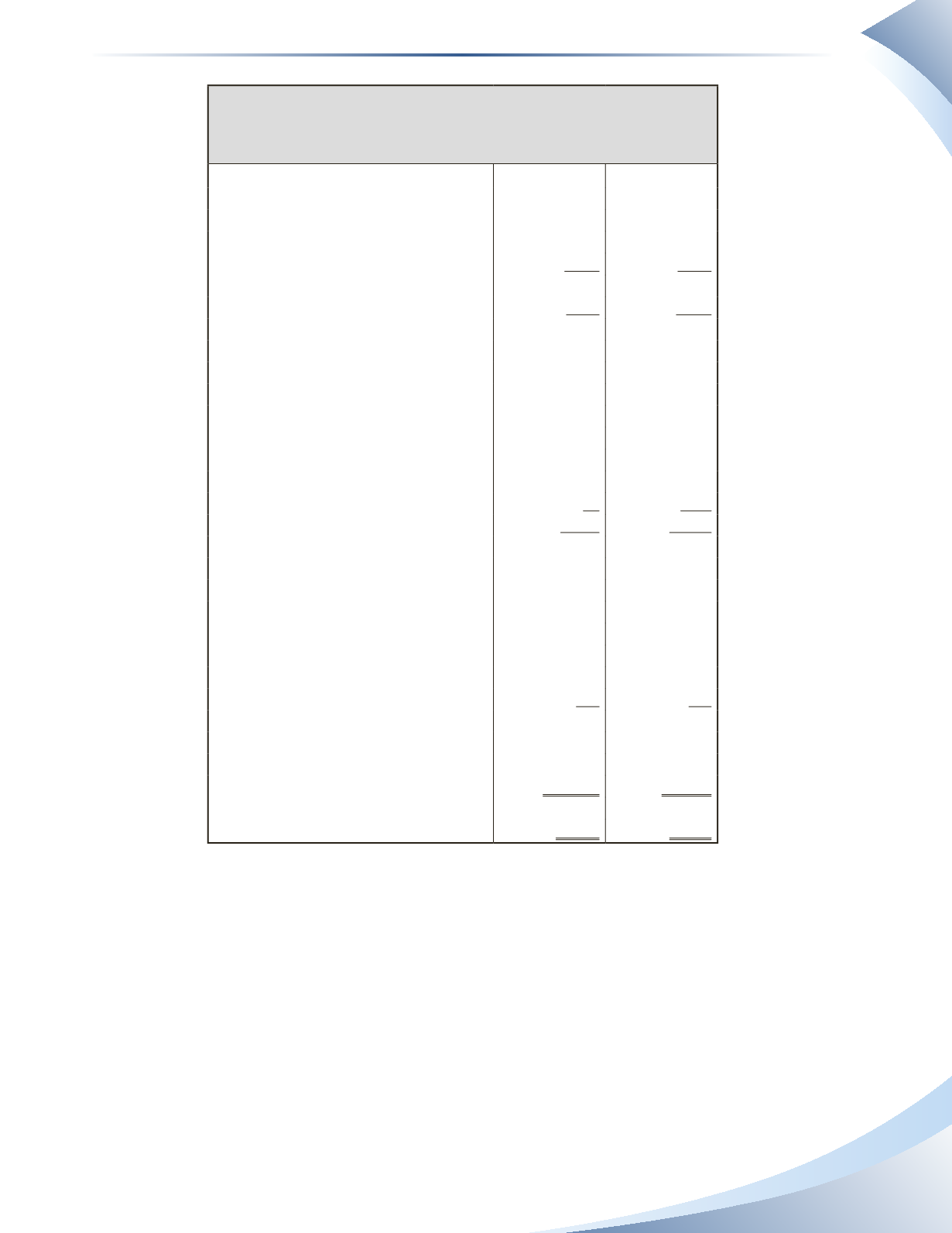

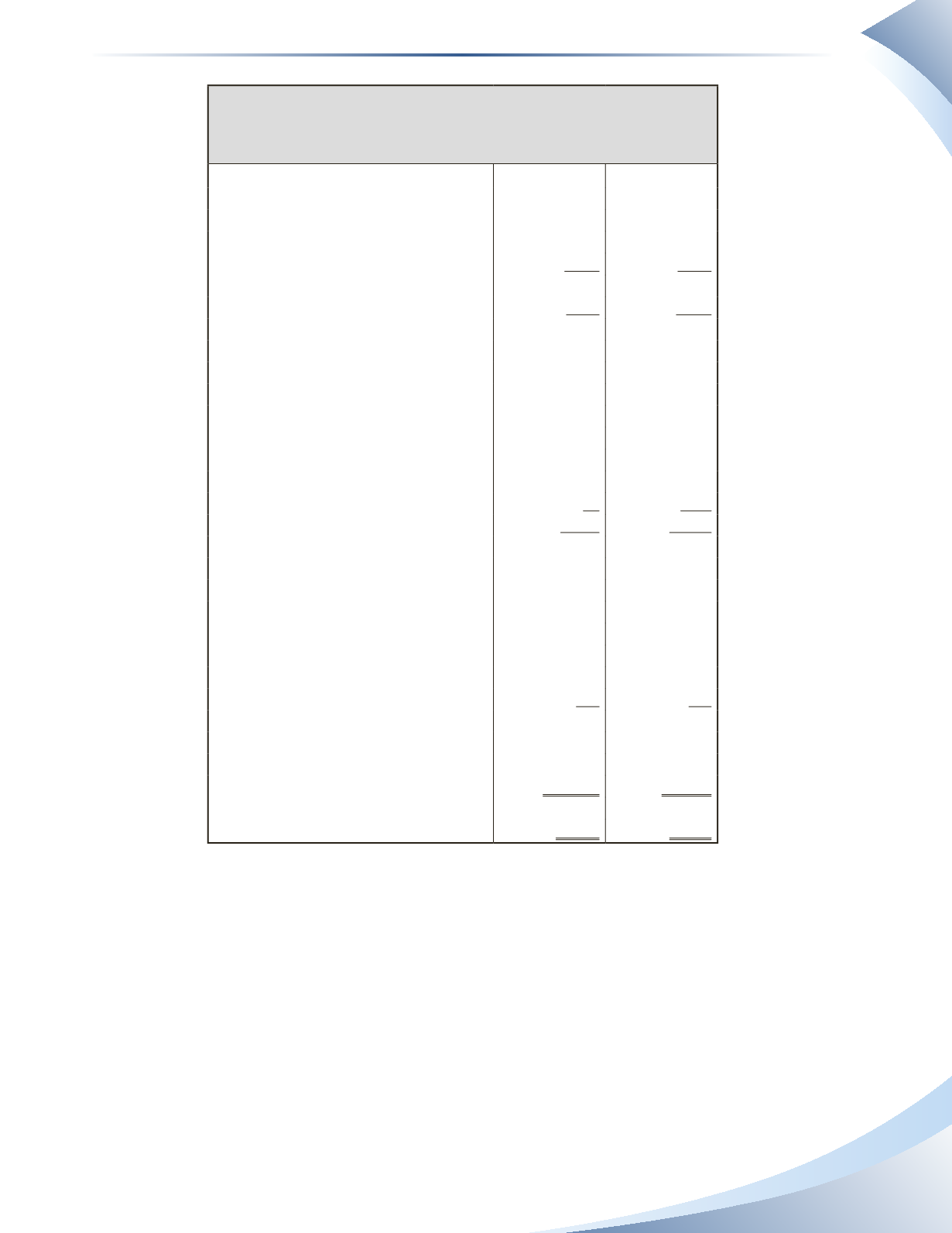

Second Cup Coffee Co.

Statement of Comprehensive Income

For the Periods Ended December 27, 2014 and December 28, 2013

(Expressed in thousands of Canadian dollars, except for per share amounts)

2014

2013

Revenue

Royalties

$12,350

$14,117

Sale of Goods

9,287

5,506

Services and Other Revenue

6,535

7,565

Total Revenue

28,172

27,188

Cost of Services

7,679

4,054

Gross Profit

20,493

23,134

Operating Expenses

Salaries, Benefits, and Incentives

6,496

6,866

Coffee Central Overheads

6,700

5,647

Depreciation Expense

933

749

Amortization Expense

339

502

Lease Expense

2,692

1,775

Loss (Gain) on Disposal of Equipment

34

(197)

Total Expenses

17,194

15,342

Operating Income

3,299

7,792

Other Revenue and Expenses

Restructuring Charges

2,166

883

Provisions for Café Closures

1,630

479

Impairment Charges

29,708

13,552

Loss on Acquisition of Cafes

692

-

Interest and Financing Expense

478

516

Loss Before Income Taxes

(31,375)

(7,638)

Income Tax Recovery

4,343

269

Net Loss

$(27,032)

$(7,369)

Basic and Diluted Loss Per Share

$(2.66)

$(0.74)

_______________

Figure 12.16

As you can see from Figure 12.16, Second Cup’s income statement is also shown in horizontal

form, allowing users to easily compare the financial results of the company over two years. We

can instantly see, for example, that Second Cup has not generated a profit for the past two years.

We can also see that revenues have remained somewhat level while expenses have significantly

increased overall, resulting in a higher net loss for 2014. In addition to these observations, several

more ratios can be calculated to assess profitability.