Chapter 2

Linking Personal Accounting to Business Accounting

32

Service Business

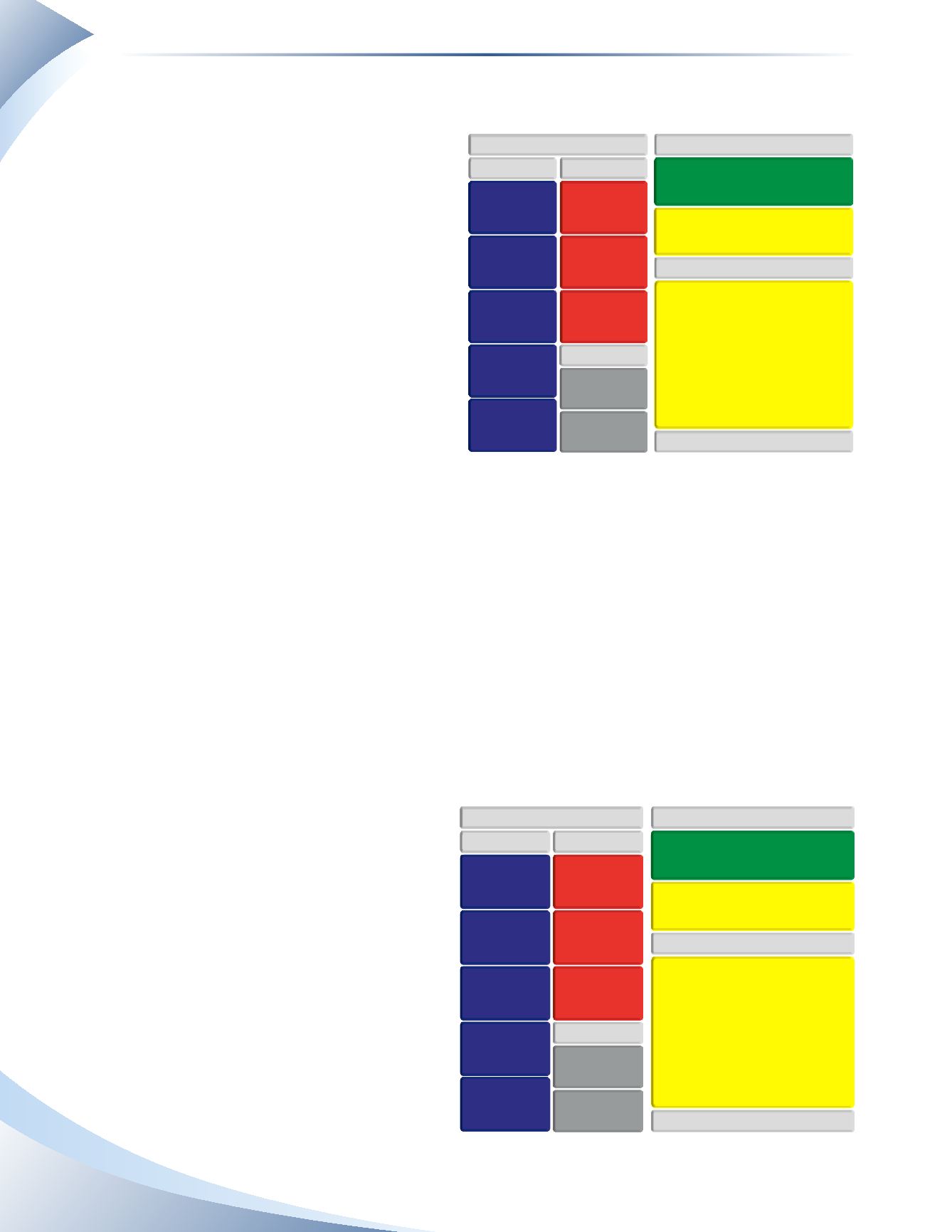

The financial statements shown in Figure

2.6 represent a simple service business.

Examples of services include accounting,

consulting, lawn maintenance or general

contracting. A fewnew items are presented

on the income statement and balance

sheet: cost of sales, gross profit and work

in progress.

Cost of sales are the expenses directly

tied to the service revenue earned. In a

consulting firm, this would be the salary

of the consultants. All other expenses

would be part of the operating expenses

(i.e. rent, insurance, depreciation, etc.).

The difference between service revenue and cost of sales is called gross profit.

Gross profit

is

used to pay for all other expenses and will be discussed in detail later in the text. Not all service

businesses will use cost of sales, in which case every expense is considered an operating expense

and there is no gross profit.

On the balance sheet, there may be an asset account called work in progress. This represents

jobs that are currently being worked on but are not yet complete. For example, a training

company in the middle of developing a training program.This partially completed work would

be eventually recognized as cost of sales and matched to revenue when the service is delivered

to the client.

Merchandising Business

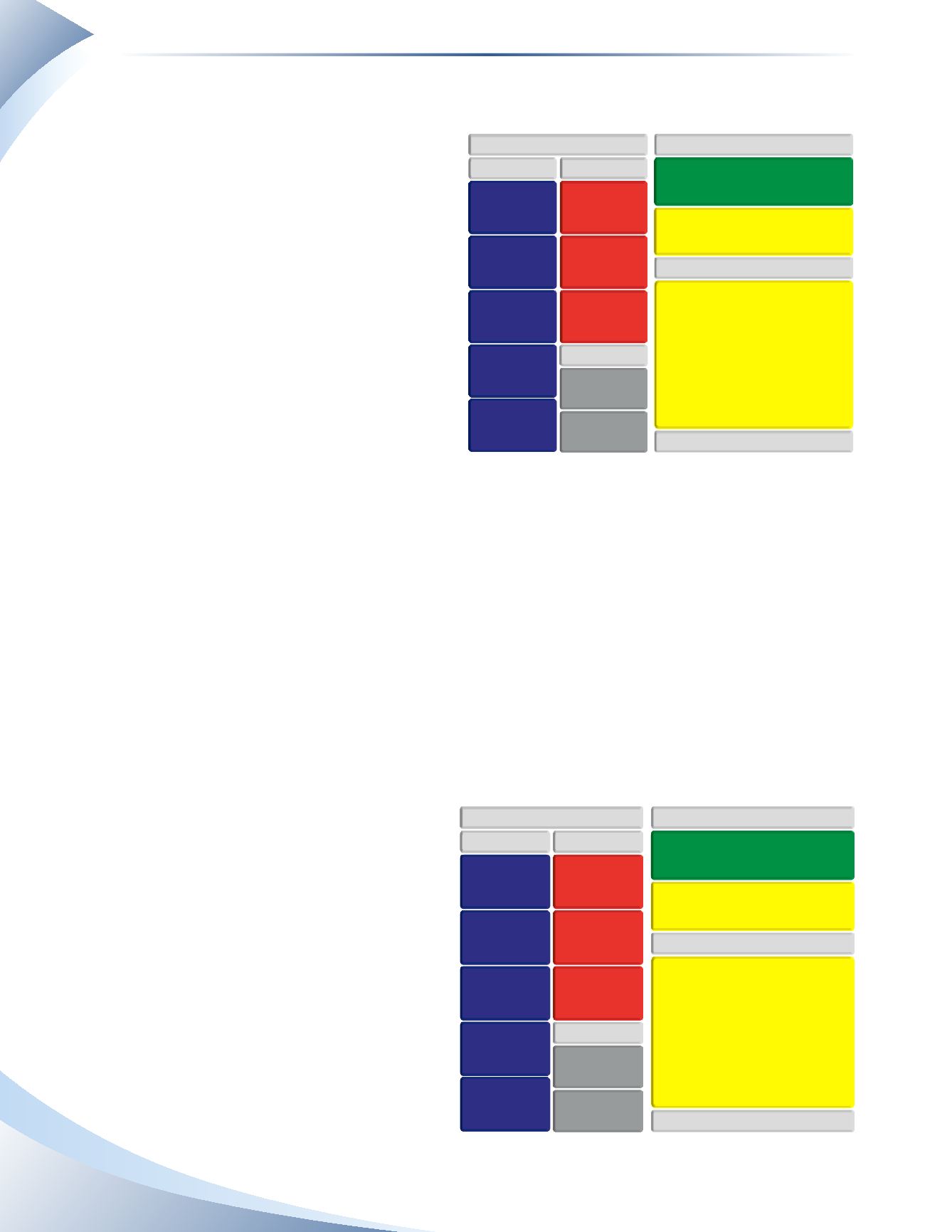

The financial statements shown in Figure

2.7 represent a merchandising business.

Any company that buys goods to resell to

customers is considered a merchandising

business. A common example is a retail

store. Examples of retail stores include

hardware, clothing, toy and convenience

stores.

On the balance sheet, there is a new

asset called inventory. This account

tracks the value of all the goods the store

has purchased and intends to sell to its

customers. Once these items are sold, the

INCOME STATEMENT

NET INCOME (LOSS)

GROSS PROFIT

OPERATING EXPENSES

SERVICE REVENUE

COST OF SALES

BALANCE SHEET

ASSETS

CASH

WORK IN

PROGRESS

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LIABILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

______________

FIGURE 2.6

______________

FIGURE 2.7

INCOME STATEMENT

NET INCOME (LOSS)

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

ASSETS

CASH

INVENTORY

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LIABILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS