Chapter 2

Linking Personal Accounting to Business Accounting

31

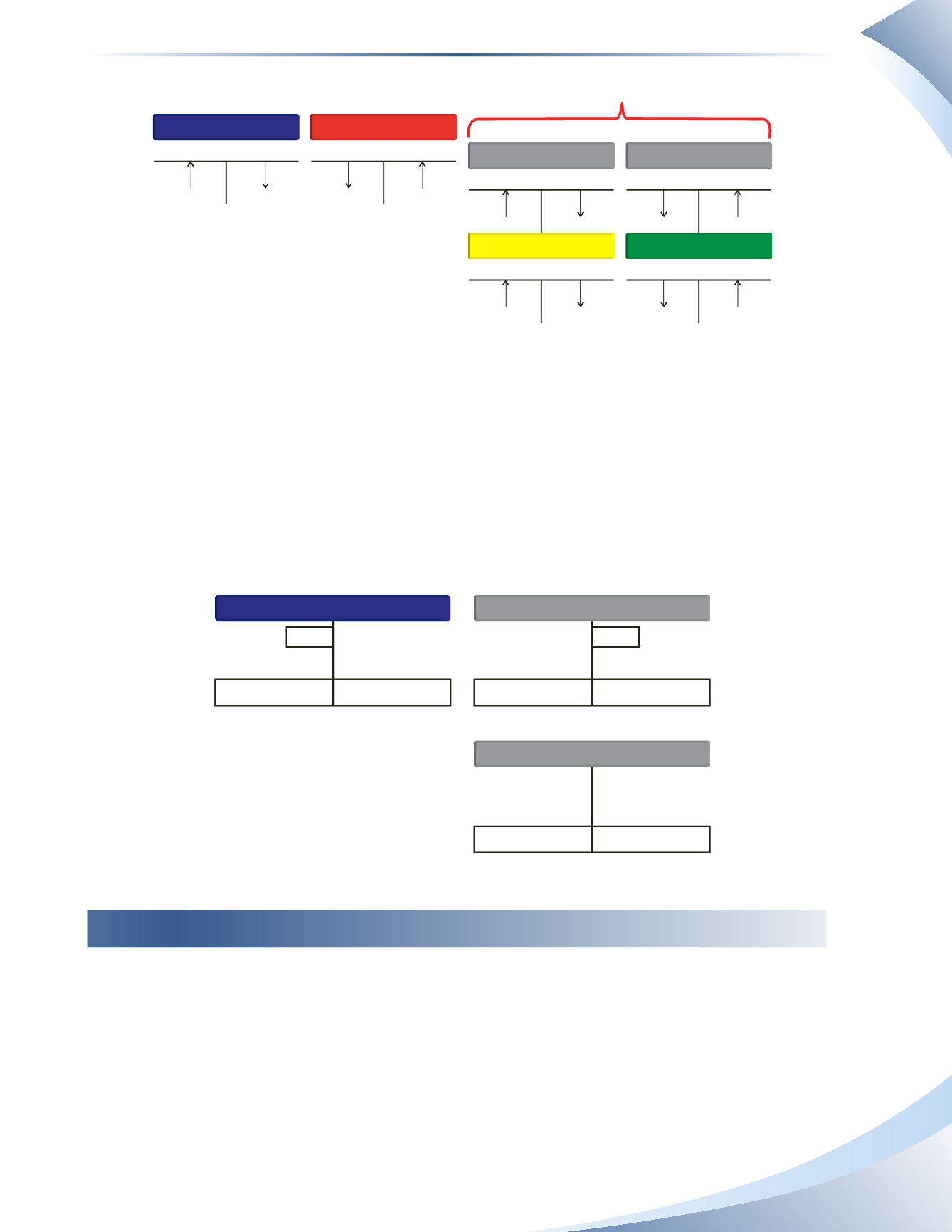

ASSETS

OWNER’S DRAWINGS

EXPENSES

OWNER’S CAPITAL

REVENUE

LIABILITIES

Increase

Increase

Increase

Increase

Owner’s Equity

Assets

=

+

Liabilities

Increase

Increase

Decrease

Decrease

Decrease

Decrease

Decrease

Decrease

______________

FIGURE 2.4

We will illustrate the T-account entries related to the owner’s capital and owner’s drawings with

an example. Suppose that the owner of a newly formed company invested $10,000 in cash into the

company (transaction 1).This will increase owner’s capital and increase cash. For simplicity, assume

that all opening account balances are $0.

Also suppose that the owner withdrew $1,000 from the company for personal use (transaction 2).

This transaction will cause cash to decrease and owner’s drawings to increase. These transactions

related to owner’s equity are summarized in Figure 2.5.

+

CASH

-

INCREASE

DECREASE

-

OWNER’S DRAWINGS

-

OWNER’S CAPITAL

+

DECREASE

INCREASE

1.

1.

2.

10,000

10,000

1,000

$1,000

$10,000

$0

$0

2.

1,000

$9,000

Opening

Balance

Opening

Balance

INCREASE

DECREASE

+

______________

FIGURE 2.5

Financial Statements of Different Types of Businesses

Different types of businesses use different financial statement layouts: a small consulting firm

would use a very simple income statement and balance sheet compared to a complex manufac-

turing company that produces goods. The manufacturing company requires a more detailed set

of financial statements, which provide the information a manager needs to know to operate the

business effectively.

The following examples display financial statements for three main types of businesses.